tt TCC

I. Introduction

During the economic development process of each country, there are times when the State needs to mobilize more resources from both domestic and international sources. In other words, when traditional revenue sources such as taxes, fees, and charges cannot meet spending demands, the State must resort to borrowing to fulfill its functions and responsibilities. Consequently, the State is also accountable for repaying those debts.

Thus, public debt can be understood as This borrowing aims to finance budget deficits accumulated up to a certain point in time. To understand the scale of government debt, it is often measured as a percentage of the Gross Domestic Product (GDP).

Most current approaches agree that public debt refers to the liabilities that a nation's government is responsible for repaying, but there are differences in scope and coverage. According to the approach of the International Monetary Fund (IMF) (2013), public debt is understood as the debt obligations of 4 groups of entities including: Debt of the central government and central ministries, departments and branches; Debt of local authorities; Debt of the central bank and debt of independent organizations in which the government owns more than 50% of capital; Debt from budget decisions must be approved by the Government or the Government is responsible for debt repayment in case that organization defaults.

According to the approach of the World Bank (WB), public debt is the entire debt repayment obligation of the public sector, including the debt repayment obligation of the Government and public organizations.

In Vietnam, according to Article 4 of the Law on Public Debt Management No. 20/2017/QH14 dated November 23, 2017, public debt includes 3 groups: Government debt; Government-guaranteed debt; Local government debt. Thus, Vietnam's view of public debt is narrower than that of international organizations, which only define public debt as debts directly related to the government, including debts of governments at all levels and debts guaranteed by the government.

The economic nature of public debt is the result of the State borrowing capital and the State must be responsible for repayment. These loans must be repaid in principal and interest when due, and the State must collect increased taxes to compensate. Therefore, borrowing is essentially a gradual taxation method, used by most governments to finance budget expenditure activities. The public debt/GDP ratio only partly reflects the safety or risk of public debt. The safety or risk of public debt depends not only on the debt/GDP ratio but more importantly, on the development status of the economy.

When considering public debt, we need to pay attention not only to the total debt and annual debt to be paid, but also to the risk and debt structure. The important issue to consider is the ability to repay debt and future risks, not just the total debt to GDP figure. Therefore, to assess the sustainability of public debt, the public debt/GDP ratio criterion is considered the most common assessment index for a general view of a country's public debt situation. The safety level of public debt is shown by whether public debt exceeds the safety threshold at a certain time or stage.

Public debt has a relatively complex relationship with sustainable economic development, expressed through many channels of impact in different directions. Public debt can impact economic development through intermediate variables, such as: inflation; interest rates; taxes and exchange rates. Regardless of the impact channels, this impact progresses in two directions, which are:

(i) Positive impact. A country that wants to develop needs resources, to some extent when domestic resources are limited, public debt will be a resource to help countries have enough capital to meet their spending and investment needs, creating a foundation for economic development. In addition, public debt also helps governments exploit domestic resources through idle financial resources among the population. Public debt borrowed from foreign countries and international organizations also helps countries expand bilateral and multilateral economic relations. On that basis, the borrowing country not only has the opportunity to access capital at preferential costs but also receives technology transfer and advanced management skills from developed countries in the world. This is a very important foundation for creating value to promote economic growth, keeping up with the progress of developed countries in the world.

(ii) Negative impacts. Large public debt will reduce national savings, leading to the phenomenon of investment withdrawal or crowding out private investment. In addition, the increase in public debt also leads to an increase in the inflation rate in the economy. A scenario that has occurred in many countries is that when public debt increases, central banks of countries finance the state budget deficit by printing more money. In the long term, this approach has led to an increase in the inflation rate in the economy when the money supply is greater than the demand for money in the economy. Not only that, the increase in public debt will also force the government to increase taxes to some extent, thereby causing unnecessary distortions in the economy. The increase in taxes in the future to compensate for current government spending will cause future household income to decrease, thereby reducing savings and consumption, which will reduce output and investment demand in the future, and economic growth will also be significantly affected.

II. Current Global Trends in Public Debt (Ngân)

An important factor to consider is what every country's debt is as a percentage of its GDP. The higher that percentage is, the more such a country must spend of its annual budget to service its debt, at the very least, the interest on its debt. Government debt, like business debt and personal debt, must be serviced, and the cost of that debt comes in the form of interest.

The higher the debt and the interest rate, the larger the portion allocated to service that debt becomes, and the less disposable income the individual, company, and country has. As far as countries are concerned, it means less money to spend on healthcare, education, social welfare, etc.

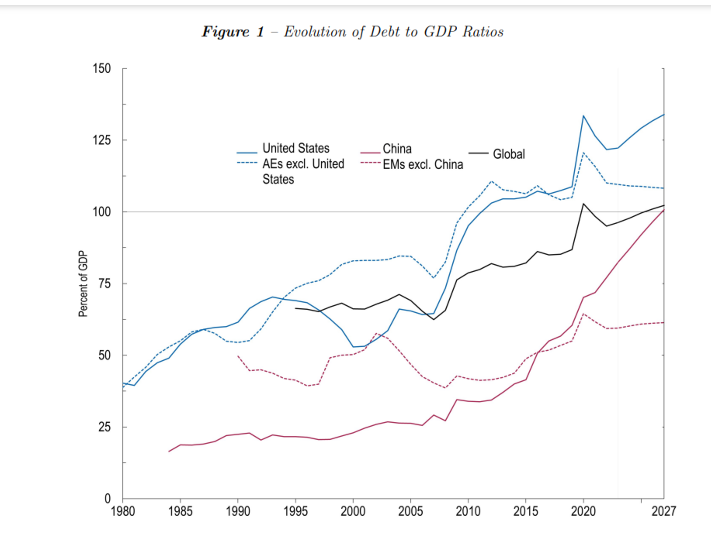

Public debt-to-GDP ratios have undergone substantial fluctuations over both the short and long term. The recent COVID-19 pandemic led to a dramatic escalation, pushing the global average ratio to nearly 100% in 2020—a 15-percentage-point increase from the previous year (Figure 1). Remarkably, the subsequent years, 2021 and 2022, saw these ratios contract, reversing approximately half of the 2020 surge. This contraction was facilitated by economic recovery, fiscal policy normalization, and inflation-induced debt deflation. This recent volatility is part of a broader historical pattern. For instance, the 1980s saw debt-to-GDP ratios rise substantially due to policy-driven welfare expansions, tax reforms, and fiscal stimuli. Conversely, the 1990s experienced declines as a result of targeted fiscal reforms and favorable economic conditions. The 2008-2009 financial crisis brought another surge, highlighting the perpetual struggle between fiscal stimulus and sustainability.

The chart shows the change in debt-to-GDP ratios of major economies over the period from 1980 to 2027.

Detailed analysis of each performance line:

United States:

The dark blue line representing the United States shows a sharp upward trend in the debt-to-GDP ratio, especially since the 2008 financial crisis and the 2020 COVID-19 pandemic.

During the pandemic, the US debt-to-GDP ratio increased sharply, indicating that the US government borrowed more to support fiscal and economic measures.

The forecast from 2022 to 2027 continues to show a slight upward trend, indicating that public debt will continue to be an important factor in the US economy.

China:

The bold red line for China has been steadily increasing since 2000, especially after 2010 when China increased its debt to fuel economic growth through infrastructure investment.

However, China's rate of increase slowed after 2020, reflecting a more cautious approach to debt management to avoid long-term financial risks.

The forecast to 2027 shows that China's debt-to-GDP ratio will continue to increase, but at a slower pace than before.

Advanced Economies Excl. United States (AEs excl. United States):

The light blue dashed line representing other advanced economies excluding the United States also shows an increasing trend, but more steadily than the United States and China.

These countries were affected by the 2008 global financial crisis and the COVID-19 pandemic, but tend to manage their debt more steadily and with fewer spikes than the United States.

After a sharp increase in 2020, these economies are likely to maintain stable debt-to-GDP ratios from 2022 onwards.

Emerging markets excl. China:

The light red dashed line represents emerging markets (excluding China) showing the lowest debt-to-GDP ratios across the groups, reflecting more conservative borrowing.

However, the ratio has been on a slow upward trend since 2000, suggesting that developing countries are also increasing their borrowing to fuel economic growth.

By 2027, these countries' debt-to-GDP ratios are expected to stabilize, possibly due to debt control policies to avoid financial risks.

Global debt ratio:

The black line represents the global debt ratio, showing a strong upward trend, especially after the financial crises and pandemics.

The global debt ratio increased from around 40% of GDP in the early 1980s to over 100% after 2020, indicating an increase in global public debt to cope with major economic shocks.

The forecast shows that this ratio will remain high until 2027, reflecting the trend of increasing global debt.

General increasing trend: The graph shows a general trend that the debt-to-GDP ratio of major economies has increased over the period under review. This shows that countries are increasingly relying on debt to finance economic activities.

Differences between country groups:

Developed countries (AEs): The US has a high debt-to-GDP ratio and remains high compared to other countries. Other developed countries (excluding the US) also tend to increase debt but at a slower and more stable rate.

Emerging countries (EMs): China and other emerging countries (excluding China) have significantly increased debt-to-GDP, especially in recent years. However, the rate of increase in these countries is still lower than that of the US.

Bạn đang đọc truyện trên: AzTruyen.Top